tax avoidance vs tax evasion uk

The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. But the major difference between them is the fact that tax avoidance although morally dubious is legal while tax evasion is illegal.

The Charity Commission Is To Focus On Compliance By Charity Legal Obligations Rigour Which It Holds Charities Accounting Services Wales England Sample Resume

Examples of tax.

. Unlike tax avoidance tax planning is the practice of minimising tax liability with no intention of deceit. They are both forms of tax noncompliance. This policy paper sets out the governments approach and achievements in tackling tax avoidance evasion and other forms of non-compliance.

Tax evasion in the UK. Think of it like bending the rules rather than breaking. So there really isnt a huge difference in definitions apart from the very last point but its the idea of escape thats crucial.

Because there is a difference between tax evasion and tax evasion. Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway. Common tax avoidance measures.

Tax avoidance involves bending the rules of the tax system to try to gain a tax advantage that Parliament never intended. Tax avoidance means exploiting legal loopholes to avoid tax. Some are taxed higher and others are taxed lower depending on the severity of the tax evasion situation.

Its as simple as that. Tax avoidance is entirely legal and is where you take steps to minimise your tax bill. Tax evasion is the deliberate non-payment of taxes that is illegal.

Furthermore it is an illegal offence. 9047 PDF 122MB 32 pages. Tax Evasion It has also been interpreted to mean an illegal practice where a person organisation or corporation deliberately evades paying their authentic tax liability.

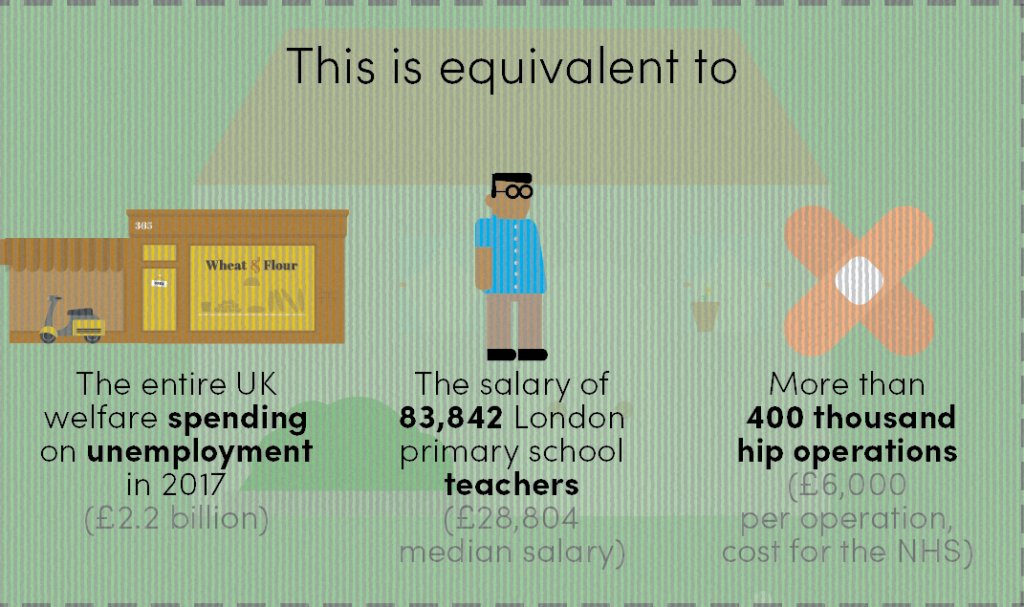

The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. It is estimated that in 201920 the financial loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion. Like many countries worldwide tax evasions in the UK are taken very seriously the heaviest punishment for avoiding taxes can result in unlimited jail time and fine.

Tax avoidance and tax evasion. Avoid giving a direct answer to a question 3. Tax avoidance may exist in a controversial area of the tax system but tax evasion most definitely doesnt.

But taxes are the law. Tax evasion is ILLEGAL. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the law.

ISBN 9781474116787 9781474116787 Cm. Genuine mistakes on a tax return such as misculautions and missed deadlines can. Tax evasion is the illegal practice of not paying taxes - by not reporting income reporting expenses not legally allowed or by not.

To many people tax avoidance simply means paying as little tax as possible while remaining on the right side of the law. Not every tax evasion case is fined the same amount. No one likes to pay taxes.

Basically tax avoidance is legal while tax evasion is not. Businesses get into trouble with the IRS when they intentionally evade taxes. Tackling tax evasion and avoidance print file Ref.

In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities. Avoidance measures are very common and members of the public are often encouraged to use them by. Tax planning either reduces it or does not increase your tax risk.

Tax Evasion What is it. It is sometimes difficult to appreciate the difference between the two but in basic terms tax evasion is deliberately escaping from paying tax that should be paid whereas tax avoidance is the exploitation of rules in order to reduce the tax that would otherwise be paid. Escape paying tax duty.

If you do decide to listen you need to be very wary because TAX AVOIDANCE is legal but TAX EVASION is not. Tax evasion means illegally hiding activities from HMRC to avoid tax. HMRC has confirmed that it has generated billions in additional tax revenue in recent years.

The difference between tax avoidance and evasion is legality. It is split into three chapters and outlines HMRCs. Tax Evasion in the UK.

One is illegal the other legal though arguably immoral on a larger scale. Over the last five years HMRC estimate that proportion of tax lost through tax evasion has stayed roughly the same whilst the proportion lost through tax avoidance appears to be falling. It is the illegal practice of not paying taxes not reporting income reporting illegitimate expenses or not making payment for taxes owed.

In its most simplistic form there are plenty of people whose financial actions may be labelled as tax avoidance. HMRC defines Tax Evasion as Concealing of taxable income or the use of benefits to avoid the tax payment Tax evaders do not disclose their taxable assets fake off-shore accounts hide the details of their income and conceal the financial reporting from HMRC. Well the most commonly used definition is that tax avoidance is legal while evasion is not.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

How Much Does Tax Avoidance Cost

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Why It S Time To Talk About Corporate Tax Adviser Schroders

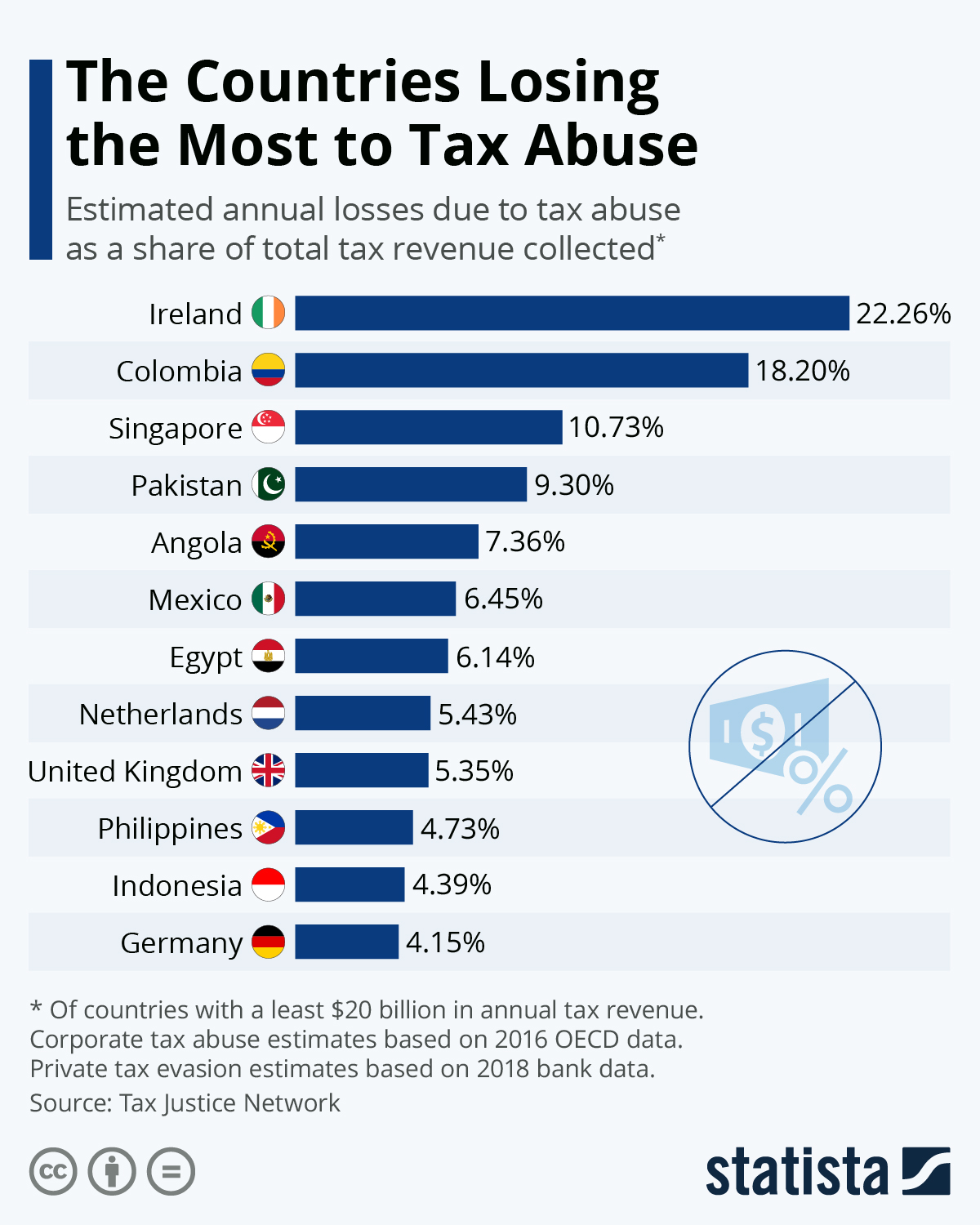

Uk Second Best At Tax Avoidance

Differences Between Tax Evasion Tax Avoidance And Tax Planning

What Are Tax Evasion And Tax Avoidance Taxes 101 Easy Peasy Finance For Kids And Beginners Youtube

Tax Avoidance Vs Tax Evasion What S The Difference

Tax Avoidance Or Tax Evasion Neither Go For Good Tax Planning Accounting Humor Fun At Work Have A Laugh

Tax Avoidance Vs Tax Evasion Understand The Difference Youtube

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Avoidance Vs Tax Evasion Expat Us Tax

Explainer What S The Difference Between Tax Avoidance And Evasion